Indiana Gambling Winnings Tax

[toc]A bill that would legalize and regulate sports betting in Indiana includes a fee on all money wagered in the state that would be paid to sports leagues to help them deal with integrity matters, according to a version of the bill acquired by Legal Sports Report.

- Indiana Gambling Winnings Tax

- Indiana Tax On Gambling Winnings

- Michigan Gambling Winnings Tax

- Indiana Gambling Winnings Taxes

- Missouri Gambling Winnings Taxable

Indiana’s legislature has been ramping up an effort to legalize sports gambling in the state in recent weeks. Like most states considering sports betting bills, Indiana is anticipating a verdict in the New Jersey sports betting case in the US Supreme Court. A victory for New Jersey could allow for legalization of sports gambling in other states.

Integrity fee for sports betting

Here’s the language that appears in the House bill:

- Indiana residents must pay a tax on all of their winnings from gambling, while non-residents must pay taxes on winnings from riverboat casinos and horse track racing gambling. Winnings valued at one thousand $1,200 or more from slot machine play and $1,500 will also incur a tax. Most gambling taxes fall into the personal income tax category at.

- If you've recently won some cash at the casino or racetrack, read this blog post from the IN Department of Revenue to find out what federal, state and local income taxes you'll owe on the winnings.

/https%3A%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F153880128%2F0x0.jpg)

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. That means your winnings are taxed the same as your wages or salary. And you must report the entire amount you receive each year on your tax return. For instance, if you claim it as an itemized deduction on your federal tax return, then no, you can't claim it on your Indiana tax return. However, if you are a professional gambler and are allowed to claim gambling losses on your federal business schedule (probably federal Schedule C), then the losses are included in federal AGI, and you'll. Casino Winnings Are Not Tax-Free. Casino winnings count as gambling income and gambling income is always taxed at the federal level. That includes cash from slot machines, poker tournaments.

A sports wagering operator shall remit to a sports governing body that has provided notice to the commission under section 2 of this chapter an integrity fee of one percent (1%) of the amount wagered on the sports governing body’s sporting events. The sports wagering operator shall remit integrity fees to the sports governing body at least once per calendar quarter.

This is the first time such an “integrity fee” will have appeared in sports wagering legislation in the US.

Per the bill, a “sports governing body” refers to “the organization that prescribes final rules and enforces codes of conduct with respect to a sporting event and the participants in the sporting event.” This would seemingly pertain to pro sports leagues such as the NBA, NFL, Major League Baseball and the NHL.

ESPN’s David Purdum is reporting that the NBA and MLB are behind the effort to include the integrity fee:

Major League Baseball, NBA working on Indiana sports betting bill that would give the leagues a cut through an 'integrity fee.' Bill introduced to day in Indiana House of Reps. Story to come.

— David Payne Purdum (@DavidPurdum) January 8, 2018

More from him here.

The bill apparently has changed since LSR talked with the House sponsor of the bill, Rep. Alan Morrison, last week. The Senate version of the bill — S 405 — is different from the House version, and does not include the so-called “integrity fee.”

The bill would allow for sports wagering through licensed gaming entities in the state. It also allows for online and mobile wagering, like the Senate version.

Wagering on collegiate sporting events also appears to still be allowed in the House version. The NCAA’s presence in the state potentially complicates that matter.

Handle vs. revenue for Indiana sports betting

The one percent figure would be on handle, or the total amount wagered by sports bettors in the state — not gross revenue.

By way of comparison, Nevada sports betting handle will clock in at just under $5 billion for 2017. That would mean roughly $50 million would go to leagues if the arrangement were hypothetically applied in Nevada. Revenue will eclipse $200 million in Nevada this year.

The bill also imposes a tax of 9.25 percent on sports betting revenue (not handle) in the state. Sports betting operators appear to be able to deduct the “integrity fee” from their gross revenue for figuring the amount of tax they owe in the state.

There is also currently an excise tax of .25 percent on sports betting handle at the federal level.

Initial reaction

The American Gaming Association, which is spearheading efforts to legalize sports wagering on behalf of the gaming industry, issued this statement Tuesday morning:

“While we applaud Representative Morrison’s efforts to bring legal, transparent sports betting to Indiana, handing sports leagues 20 percent of what’s left over after winnings are paid out, undercuts its economic viability. Doing so will ensure the illegal market continues to thrive in the state, and gut the tax revenues available to fund essential public services. We believe Indiana taxpayers deserve better.

“We encourage Indiana to reject this short-sighted, misinformed idea, which simply replaces a failed federal prohibition with bad state policy. Our goal is to eliminate the illegal market, protect consumers and strengthen the integrity of the game. We invite all stakeholders to join us in working together in a thoughtful and transparent fashion.”

Leagues can ‘limit wagering’

The bill also provides a mechanism for the defined “sports governing bodies” to limit wagering on some events:

Subject to subsection (b), a sports governing body may at its election notify the commission that it desires to restrict or limit wagering on a sporting event conducted by the governing body to ensure the integrity of its contests, by providing notice in the form and manner required by the commission.The restrictions or limits may include restrictions on the sources of data and associated video upon which an operator may rely in offering and paying wagers and the bet types that may be offered.

The description of contests on which wagering can be limited appears only to include minor-league and lower level college contests. That would be the equivalent of leagues having a way to take certain games “off the board” at sportsbooks in the state.

More Articles

Do you like to gamble? If so, then you should know that the taxman beats the odds every time you do. The Internal Revenue Service and many states consider any money you win in the casino as taxable income. This applies to all types of casual gambling – from roulette and poker tournaments to slots, bingo and even fantasy football. In some cases, the casino will withhold a percentage of your winnings for taxes before it pays you at the rate of 24 percent.

Indiana Gambling Winnings Tax

Casino Winnings Are Not Tax-Free

Casino winnings count as gambling income and gambling income is always taxed at the federal level. That includes cash from slot machines, poker tournaments, baccarat, roulette, keno, bingo, raffles, lotteries and horse racing. If you win a non-cash prize like a car or a vacation, you pay taxes on the fair market value of the item you win.

By law, you must report all your winnings on your federal income tax return – and all means all. Whether you win five bucks on the slots or five million on the poker tables, you are technically required to report it. Job income plus gambling income plus other income equals the total income on your tax return. Subtract the deductions, and you'll pay taxes on the resulting figure at your standard income tax rate.

How Much You Win Matters

While you're required to report every last dollar of winnings, the casino will only get involved when your winnings hit certain thresholds for income reporting:

- $5,000 (reduced by the wager or buy-in) from a poker tournament, sweepstakes, jai alai, lotteries and wagering pools.

- $1,500 (reduced by the wager) in keno winnings.

- $1,200 (not reduced by the wager) from slot machines or bingo

- $600 (reduced by the wager at the casino's discretion) for all other types of winnings but only if the payout is at least 300 times your wager.

Win at or above these amounts, and the casino will send you IRS Form W2-G to report the full amount won and the amount of tax withholding if any. You will need this form to prepare your tax return.

Understand that you must report all gambling winnings to the IRS, not just those listed above. It just means that you don't have to fill out Form W2-G for other winnings. Income from table games, such as craps, roulette, blackjack and baccarat, do not require a WG-2, for example, regardless of the amount won. It's not clear why the IRS has differentiated it this way, but those are the rules. However, you still have to report the income from these games.

What is the Federal Gambling Tax Rate?

Standard federal tax withholding applies to winnings of $5,000 or more from:

- Wagering pools (this does not include poker tournaments).

- Lotteries.

- Sweepstakes.

- Other gambling transactions where the winnings are at least 300 times the amount wagered.

If you win above the threshold from these types of games, the casino automatically withholds 24 percent of your winnings for the IRS before it pays you. If you cannot provide a Social Security number, the casino will make a 'backup withholding.' A backup withholding is also applied at the rate of 24 percent, only now it includes all your gambling winnings from slot machines, keno, bingo, poker tournaments and more. This money gets passed directly to the IRS and credited against your final tax bill. Before December 31, 2017, the standard withholding rate was 25 percent and the backup rate was 28 percent.

The $5,000 threshold applies to net winnings, meaning you deduct the amount of your wager or buy-in. For example, if you won $5,500 on the poker tables but had to buy in to the game for $1,000, then you would not be subject to the minimum withholding threshold.

It's important to understand that withholding is an entirely separate requirement from reporting the winning on Form WG-2. Just because your gambling winning is reported on Form WG-2 does not automatically require a withholding for federal income taxes.

Can You Deduct Gambling Losses?

If you itemize your deductions on Schedule A, then you can also deduct gambling losses but only up to the amount of the winnings shown on your tax return. So, if you won $5,000 on the blackjack table, you could only deduct $5,000 worth of losing bets, not the $6,000 you actually lost on gambling wagers during the tax year. And you cannot carry your losses from year to year.

Indiana Tax On Gambling Winnings

The IRS recommends that you keep a gambling log or spreadsheet showing all your wins and losses. The log should contain the date of the gambling activity, type of activity, name and address of the casino, amount of winnings and losses, and the names of other people there with you as part of the wagering pool. Be sure to keep all tickets, receipts and statements if you're going to claim gambling losses as the IRS may call for evidence in support of your claim.

What About State Withholding Tax on Gambling Winnings?

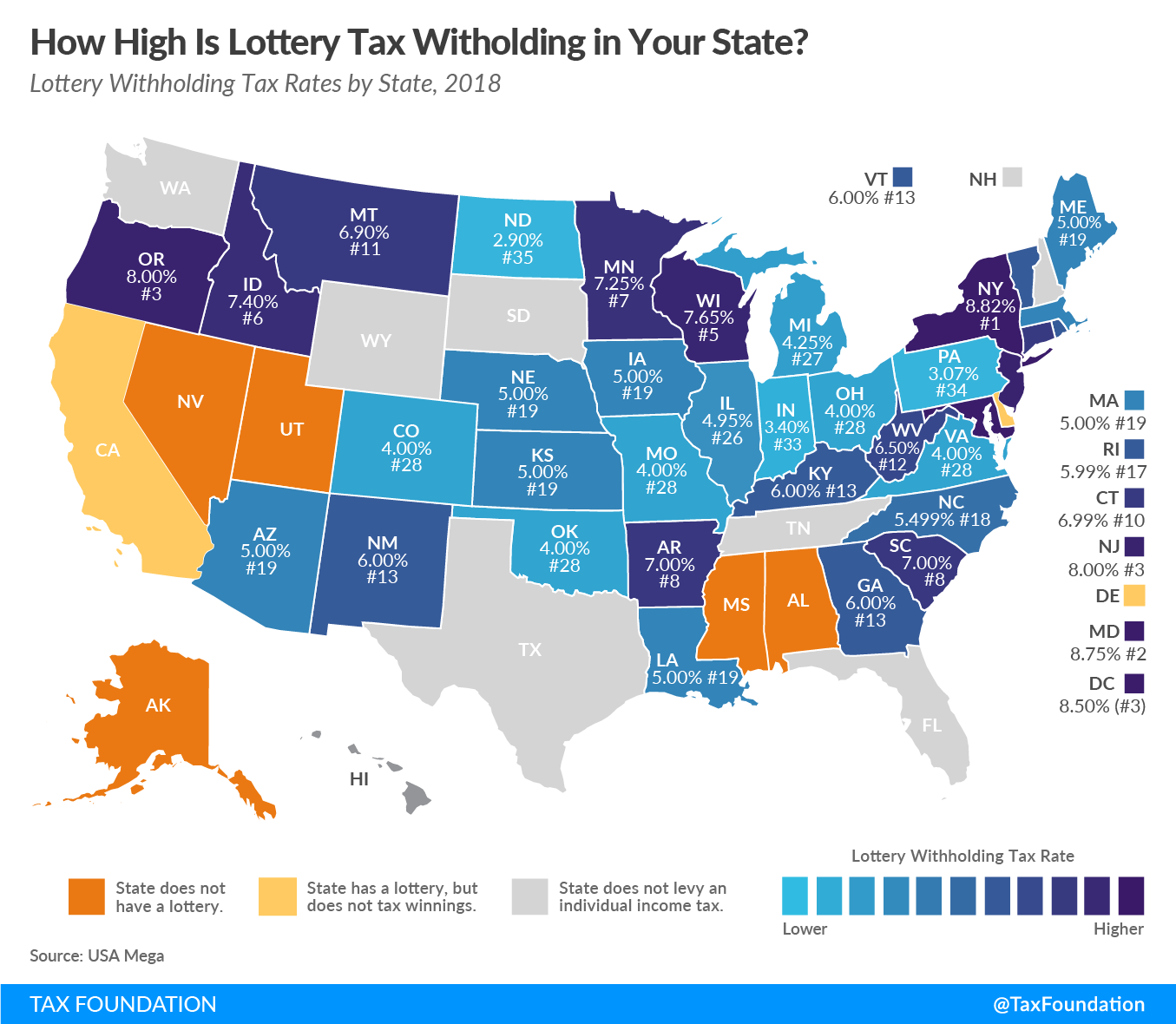

There are good states for gamblers and bad states for gamblers. If you're going to 'lose the shirt off your back,' you might as well do it in a 'good' gambling state like Nevada, which has no state tax on gambling winnings. The 'bad' states tax your gambling winnings either as a flat percentage of the amount won or by ramping up the percentage owed depending on how much you won.

Each state has different rules. In Maryland, for example, you must report winnings between $500 and $5,000 within 60 days and pay state income taxes within that time frame; you report winnings under $500 on your annual state tax return and winnings over $5,000 are subject to withholding by the casino due to state taxes. Personal tax rates begin at 2 percent and increase to a maximum of 5.75 percent in 2018. In Iowa, there's an automatic 5 percent withholding for state income tax purposes whenever federal taxes are withheld.

State taxes are due in the state you won the income and different rules may apply to players from out of state. The casino should be clued in on the state's withholding laws. Speak to them if you're not clear why the payout is less than you expect.

How to Report Taxes on Casino Winnings

Michigan Gambling Winnings Tax

You should receive all of your W2-Gs by January 31 and you'll need these forms to complete your federal and state tax returns. Boxes 1, 4 and 15 are the most important as these show your taxable gambling winnings, federal income taxes withheld and state income taxes withheld, respectively.

You must report the amount specified in Box 1, as well as other gambling income not reported on a W2-G, on the 'other income' line of your IRS Form 1040. This form is being replaced with a simpler form for the 2019 tax season but the reporting requirement remains the same. If your winnings are subject to withholding, you should report the amount in the 'payment' section of your return.

Indiana Gambling Winnings Taxes

Missouri Gambling Winnings Taxable

Different rules apply to professional gamblers who gamble full time to earn a livelihood. As a pro gambler, your winnings will be subject to self-employment tax after offsetting gambling losses and after other allowable expenses.